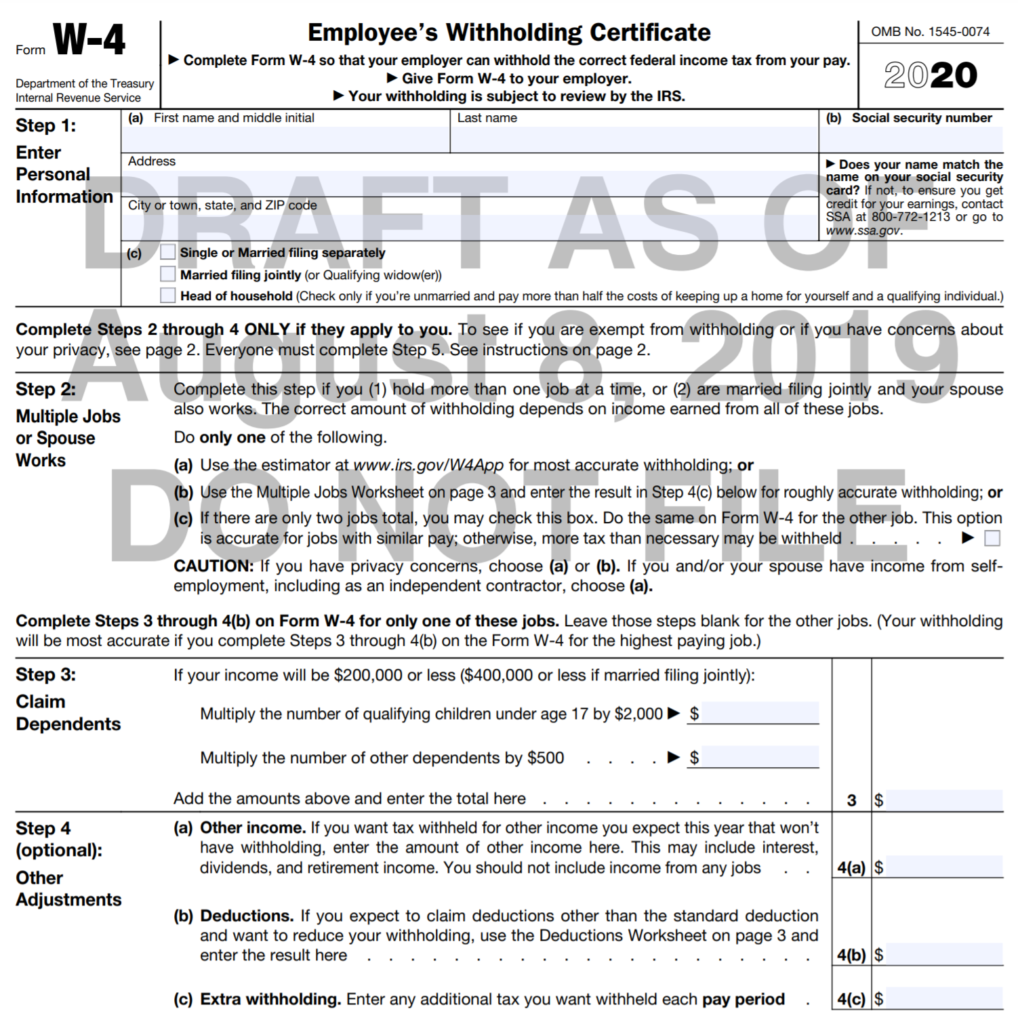

2025 Nys Withholding Form. If you retire and do not submit your withholding information, we will apply the irs default withholding status of single with no adjustments. Keep this certificate with your records.

2195 to inform agencies of processing requirements for employees who claim exempt from. Most nyslrs pensions are subject to federal income tax.

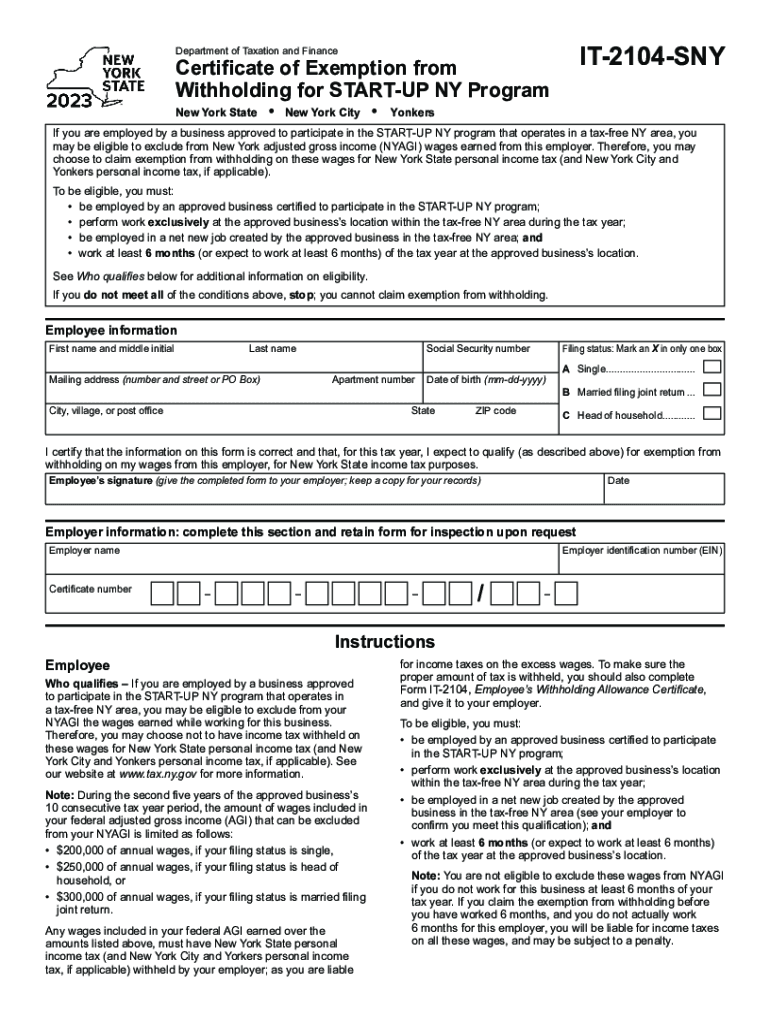

What is this form for to identify and withhold the correct new york state, new york city, and/or yonkers tax.

Did The Federal Withholding Change For 2025 Ilise Leandra, Most nyslrs pensions are subject to federal income tax. On january 31, 2025, the state comptroller's office issued state agencies bulletin no.

2025 Ny State Withholding Form Printable Forms Free Online, What is this form for. If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1”.

Va Withholding Form 2025 Dayle Erminie, 2) completion of form it. The form includes information about residency, marital status, and allowances of the employees.

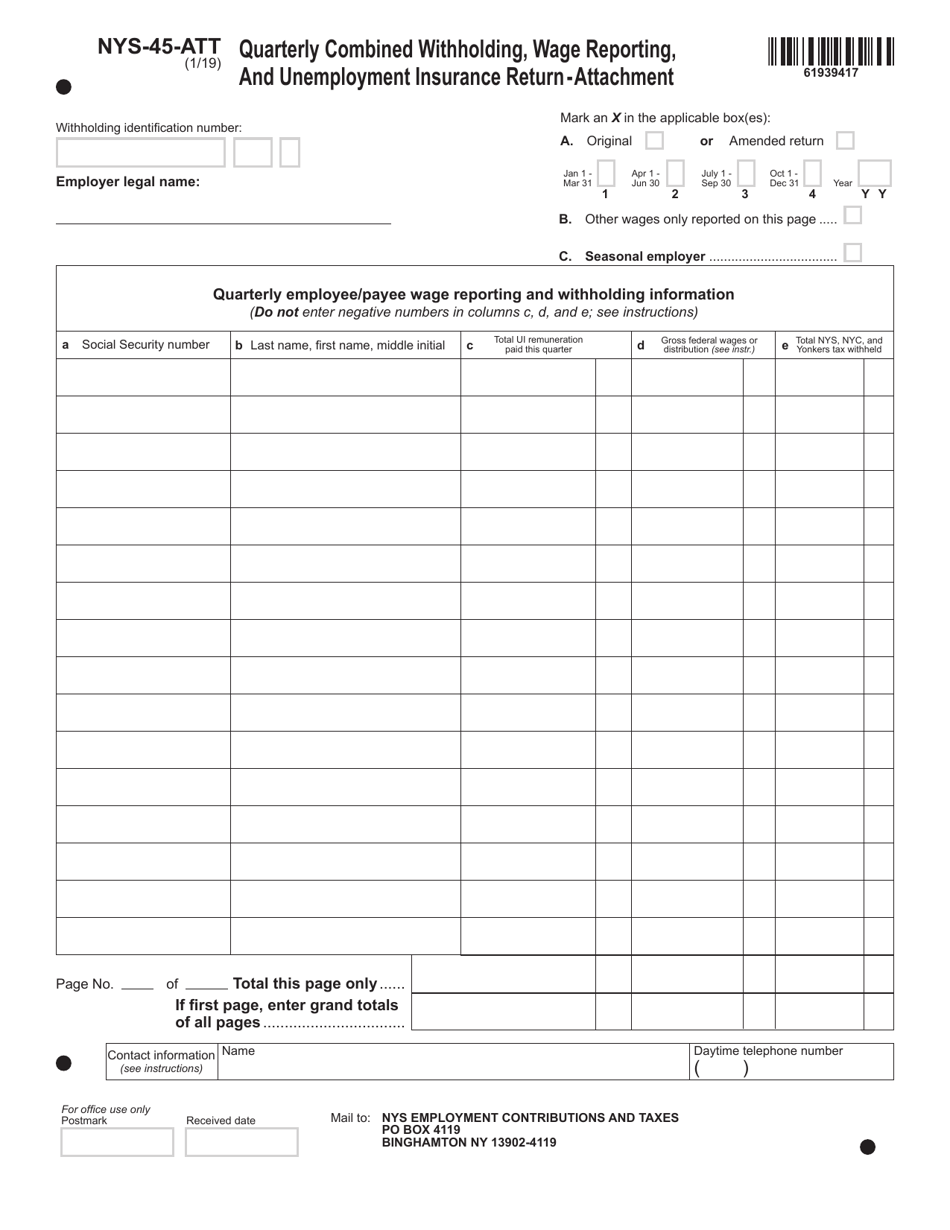

Irs New Tax Employee Forms 2025, For 2025, the tax rate for new employers is 4.1%, while the tax rates for established employers range from 2.1% to 9.9%. 2200 to inform agencies of the updated irs (internal revenue service) tax withholding.

What Is 2025 Withholding Certificate Form Imagesee Vrogue, If you retire and do not submit your withholding information, we will apply the irs default withholding status of single with no adjustments. On january 3, 2025, the state comptroller's office issued state agencies bulletin no.

Form NYS45ATT Fill Out, Sign Online and Download Fillable PDF, New, The new york department of taxation and finance released proposed regulations that include revised wage bracket and percentage method income tax withholding tables for. Updated income tables to reflect higher.

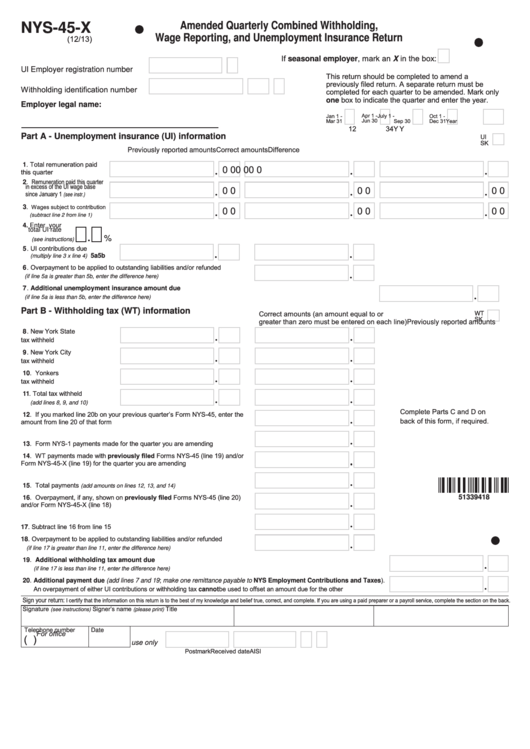

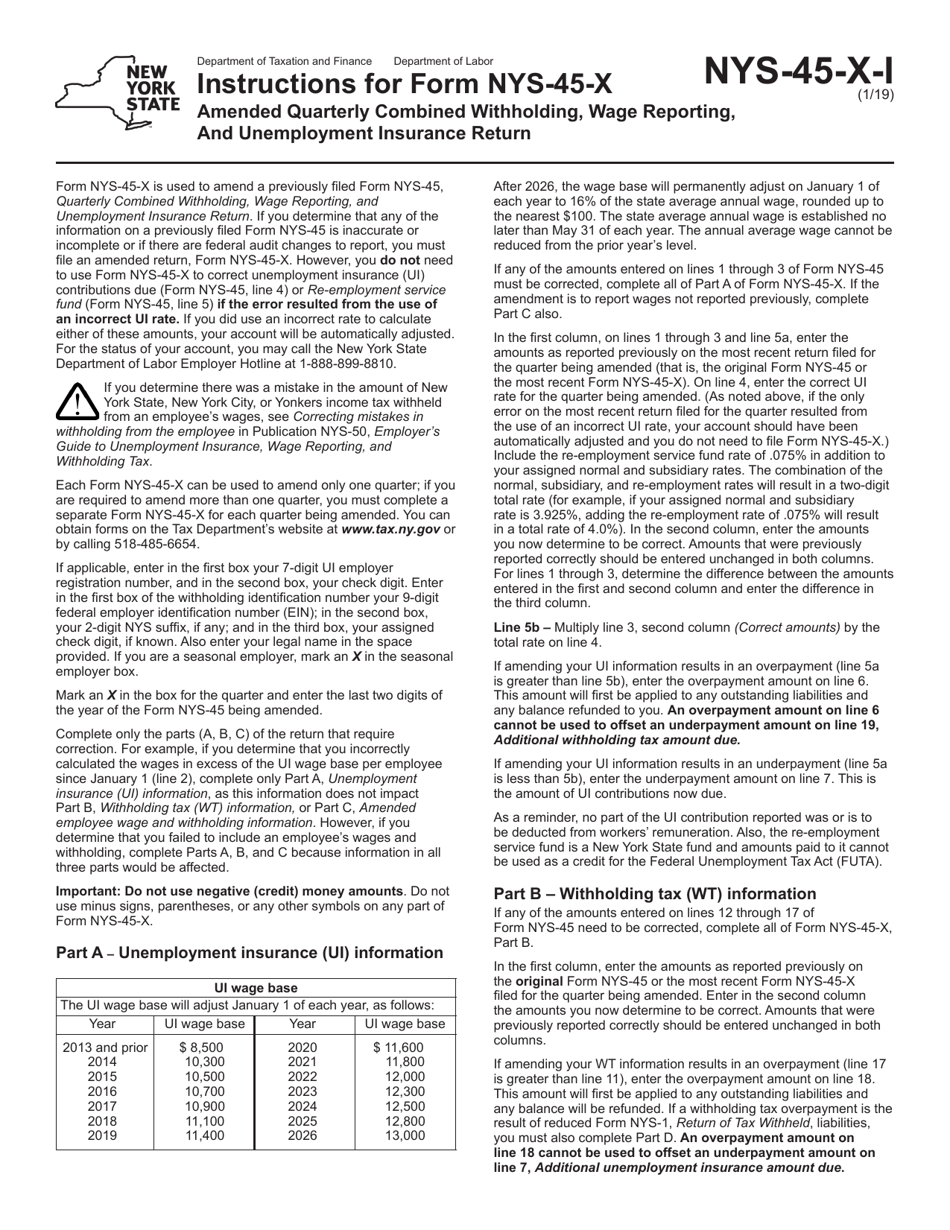

Fillable Form Nys45X Amended Quarterly Combined Withholding, Wage, Added information about changes to higher tier income taxation; The 2025 tax rates and thresholds for both the new york state tax tables and federal tax tables are comprehensively integrated into the.

Download Instructions for Form NYS45X Amended Quarterly Combined, If your last federal tax bill or return was larger than you expected and you want to change the amount. For 2025, the tax rate for new employers is 4.1%, while the tax rates for established employers range from 2.1% to 9.9%.

New York State Fillable Tax Forms Printable Forms Free Online, What is this form for. Most nyslrs pensions are subject to federal income tax.

2025 Form NY DTF IT201X Fill Online, Printable, Fillable, Blank, 1) revised 2025 state individual income tax rate schedules to reflect income tax rate reductions; If you do not submit this form, your withholdings will default to a filing status of “single” and you claim “1”.